How Much Money Is There In The World? Unpacking Global Wealth & Its Distribution

Have you ever paused to wonder, "Just how much money is there in the world?" It's a question that sparks curiosity, conjuring images of overflowing vaults and endless riches. But the answer is far more complex and fascinating than a simple dollar figure. Money isn't just the coins in your pocket or the bills in your wallet; it's a vast, intricate web of physical currency, digital bytes, financial assets, and even abstract concepts like credit and debt. Understanding the true scope of global money requires looking beyond the obvious.

In this article, we'll embark on a journey to explore the origins, various forms, and staggering quantity of money circulating (and not circulating) across our planet. We'll delve into eye-opening statistics, uncover the hidden layers of global wealth, and even peek into what the future might hold for our financial landscape.

Defining "Money": More Than Just What's In Your Wallet

When we talk about "money," what exactly are we referring to? Is it just physical cash? Or does it encompass much more? The truth is, the definition of money can vary depending on the context, leading to different, albeit equally mind-boggling, figures.

- Permanent Loc Extensions Atlanta

- Anna Sanford

- Does Embossing Powder Expire

- Strawberry Shortie

- Brooke Williams Basketball

Physical Cash vs. Broader Definitions

At its most basic, money refers to physical currency – the banknotes and coins we use for everyday transactions. However, this is just the tip of the iceberg. Economists often use broader measures, such as the "money supply," which includes not only physical cash but also funds held in checking accounts, savings accounts, and other highly liquid assets. A common measure, known as M2 money supply, gives us a clearer picture of readily available funds.

According to data collected by CEIC, the global M2 money supply in 2024 stood at an astonishing $123.3 trillion (European billions, which translates to $123.3 trillion USD). This figure represents the total amount of cash, checking deposits, savings deposits, and money market accounts across the globe. It's a substantial sum, representing the liquid assets that power our daily economies.

The Enormous Pool of Global Wealth

Beyond the money supply, there's the concept of "total global wealth" or "patrimony." This is a much larger figure, encompassing not just cash and deposits, but also real estate, stocks, bonds, business equity, and other financial and non-financial assets. It represents the accumulated value of everything owned by individuals, corporations, and governments worldwide.

According to various estimates, including reports like the UBS Global Wealth Report 2024, the total global wealth is estimated to be around an astounding $570 trillion. This monumental figure highlights the vastness of human accumulated assets. Within this immense sum, approximately $50.4 trillion is estimated to be in highly liquid assets like physical cash and readily accessible deposits. Interestingly, a smaller, yet rapidly growing, segment is virtual money, accounting for about 0.59% of this total wealth, primarily in the form of cryptocurrencies and other digital assets.

Where Does All This Money Come From?

The origin of money is rooted in human history, evolving from barter systems to precious metals, and eventually to the fiat currencies we use today. But in modern times, how is this vast sum generated and sustained?

A significant portion of global wealth is intrinsically linked to economic activity. The sum of the nominal Gross Domestic Product (GDP) of all countries worldwide, as reported by institutions like the International Monetary Fund (IMF), gives us a snapshot of the world's annual economic output. This continuous production of goods and services is the engine that creates new wealth and circulates existing money. Furthermore, central banks play a crucial role in managing the money supply through monetary policy, influencing everything from interest rates to inflation.

The Digital Revolution: Virtual Money and Its Rise

The 21st century has introduced a new dimension to the concept of money: the digital realm. Cryptocurrencies like Bitcoin and Ethereum, along with other digital assets, have emerged as a significant, albeit still relatively small, part of the global financial landscape. While they currently represent a modest fraction of total wealth (around 0.59%), their impact and potential for growth are undeniable.

The rise of digital currencies poses intriguing questions about the future of money. Will physical cash eventually become obsolete? How will central banks adapt to decentralized digital assets? The rapid evolution of financial technology suggests that the amount and nature of money in the world will continue to transform dramatically. As we look towards 2025 and beyond, statistics on digital currencies and financial assets are becoming increasingly impactful, shaping how we think about wealth and transactions.

The Uneven Pie: How Global Wealth Is Distributed

While the total amount of money and wealth in the world is staggering, its distribution is anything but equal. This is perhaps one of the most striking and often debated aspects of global finance.

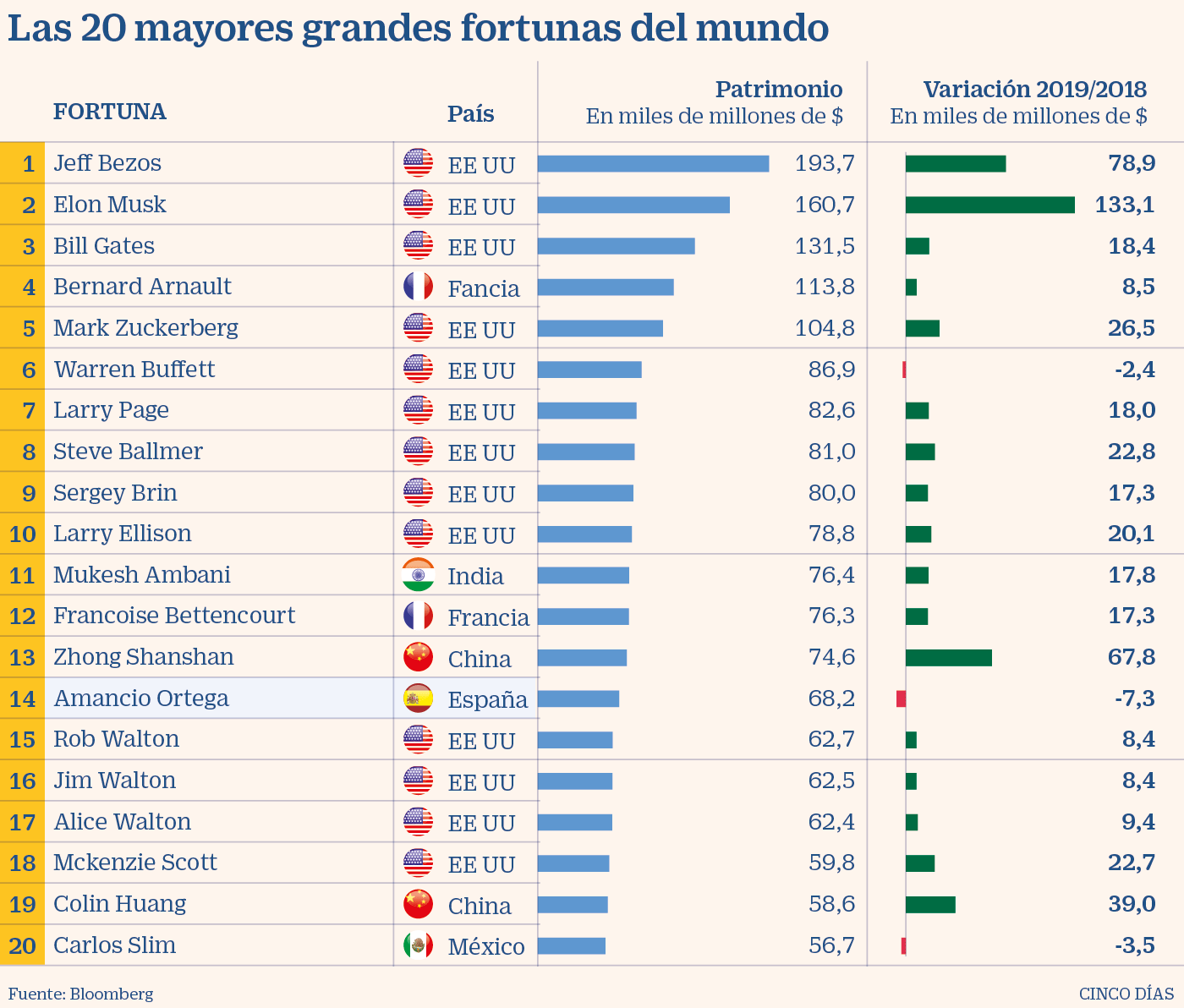

According to various sources, including reports from Credit Suisse and Popcoin, a disproportionate amount of global wealth is concentrated in the hands of a very small percentage of the population. It's often cited that roughly half of the world's money belongs to just one percent of the global population. For instance, the UBS Global Wealth Report 2024 indicates that there are 58 million adults worldwide with a net worth exceeding $1 million. Another report from Credit Suisse highlighted that in 2017, approximately 1.2% of the global population held over $1 million in wealth, collectively controlling an estimated $221 trillion.

This stark inequality highlights the complex interplay of economic systems, policies, and historical factors that lead to such disparities. Understanding this distribution is crucial for analyzing global economic trends, social mobility, and the impact of financial crises.

Money in Motion: Circulation and Global Flows

Money is rarely static. It constantly moves, circulates, and transforms. This dynamic movement is what drives global economies, facilitates trade, and creates new opportunities (and challenges).

The article analyzes the total amount and circulation of money in the world, along with the factors that determine it and how it moves between countries. Institutions like the Bank for International Settlements (BIS) play a critical role in monitoring these global financial flows, ensuring stability and facilitating cross-border transactions. Beyond physical movement, money also flows through complex financial markets, where investments, debts, and credits are constantly exchanged. Global debt, for instance, represents a significant portion of this interconnected financial system, influencing everything from national budgets to international relations.

The Future of Money: What Lies Ahead?

The landscape of global money is ever-changing. The rise of digital currencies, the ongoing challenges of wealth inequality, and the increasing interconnectedness of global financial markets all point to a future where money will continue to evolve in fascinating ways. How will economic policies adapt to these shifts? What role will new technologies play in shaping our financial interactions? These are questions that economists, policymakers, and everyday citizens will grapple with in the years to come.

The amount of money in the world, its impact on the economy, and its future are themes that remain central to our understanding of global society. The conversation around money is not just about numbers; it's about power, access, innovation, and the very fabric of human interaction.

In summary, the question "How much money is there in the world?" reveals a multi-layered reality. We've seen that the global M2 money supply stands at approximately $123.3 trillion, representing liquid assets. However, the total global wealth, encompassing all assets, soars to an estimated $570 trillion. Within this vast sum, physical cash and readily accessible deposits account for around $50.4 trillion, with virtual money making up a small but growing 0.59%. This immense wealth is, however, unevenly distributed, with a significant portion concentrated among a small percentage of the global population. Money, in all its forms, is a dynamic force, constantly circulating and evolving, shaping economies and societies worldwide.

¿Cuánto dinero hay en el mundo? (2020) — Saber es práctico

Los 50 más ricos del mundo elevan su fortuna en 640.000 millones en el

¿Cuánto dinero hay en el mundo? (2020) — Saber es práctico